Trust is good, caution even better

In May and the first few days of June, stock markets around the world reacted to the announced Covid-19 support measures with profits and continued their recovery. The S&P 500 index is now trading close to the same level as at the beginning of the year. This shows how much confidence investors have in the central banks. They seem to think that central banks won't let anything bad happen.

This confidence is also nourished by the fact that there are more and more signs of recovery in the leading economic indicators. Also, our VP Bank Corona Crisis Barometer has moved away from its low point and is showing sustained positive momentum. Does that mean the worst is already over? There are many indications that it is. But the path back to normality is still a long and hard one. A foretaste of this is provided by developments in China. After an initial strong revival, retail sales have improved only slightly of late.

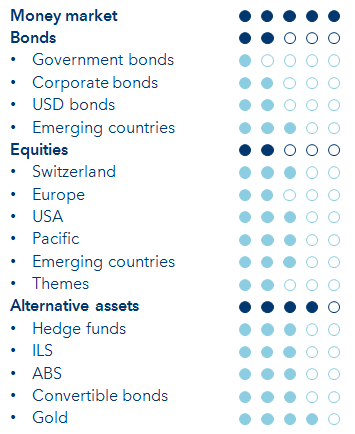

As welcome as the latest development is, we caution against relying too heavily on the fact that the recovery will be without setbacks thanks to support from monetary and fiscal policy. As in social life, we believe it is advisable to continue to take certain precautions with regard to the portfolio. Sensible diversification helps to cushion any setbacks on the equity markets. On the equity side, we confirm our cautious tactical positioning. We are also hedging the US dollar completely again.

Add the first comment